Is your mortgage deal ending?

If your existing Skipton mortgage deal is coming to an end and you believe that you may struggle with increased payments as a result of higher interest rates, you can get in touch with us to discuss potential mortgage options we have to help you on 0345 850 1766.

Managing your mortgage

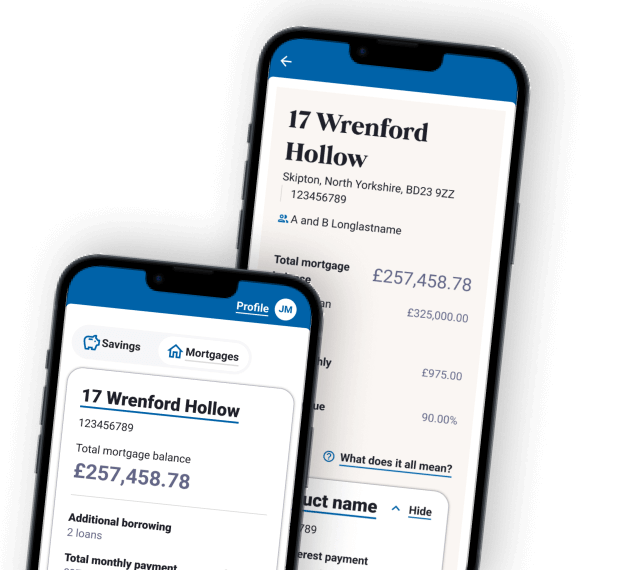

Our new mobile app is coming

We’re gradually inviting members through our current app, so don't worry if your invite hasn't arrived yet. The new app is designed to make managing your accounts easier with a fresh look and features shaped by your feedback – plus more updates coming soon.

Find out more