Easy Access Savings (ISAs)

Why choose an Easy Access savings account?

How do Easy Access accounts work?

How do I open an Easy Access account online?

You can open an Easy Access account online by selecting the relevant product above.

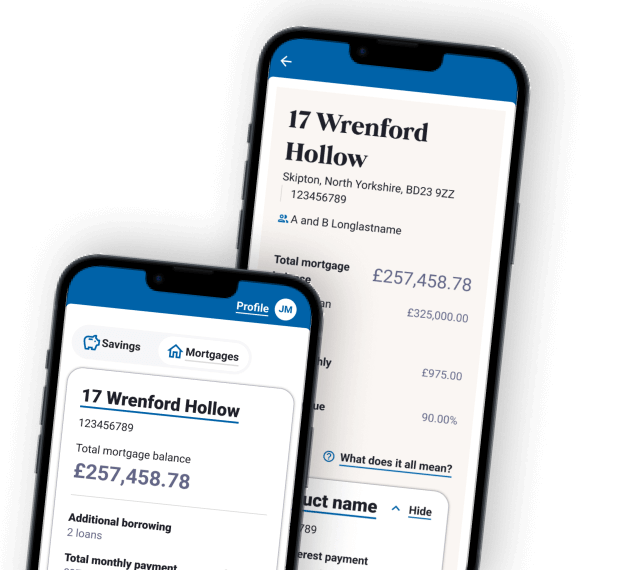

If you prefer, you can visit any Skipton Building Society branch or call us on 0345 850 1722. You can also apply for an account by post or using our app.

When your account is open you can manage it flexibly. For example, you can use our Skipton Building Society app, our website, and your local branch.

Can I open an Easy Access account as a joint account?

You can have joint accounts for our Easy Access savings (unless the account terms say otherwise). However, you can’t open joint accounts through our app.

Can I withdraw from an Easy Access account?

Yes. We offer Easy Access savings accounts that allow you to make withdrawals, as long as you don't go below the minimum operating balance. Some options let you withdraw money when you need it, others have limits on how often you can access your savings. You should check the terms of the product first.

Frequently Asked Questions

An Easy Access savings account can help you prepare for short-term goals and life’s twists and turns. It allows you to save flexibly in a way that suits you, your lifestyle and your financial priorities.

- These types of accounts are useful for money you can put away but still want to keep within easy reach when you need it.

- For example, saving for a holiday, a major purchase like a car, or getting ready for Christmas.

- Easy Access savings accounts can also support you during those frustrating but inevitable moments when you face an unexpected large bill. Home repairs, for example. Or if something breaks and needs replacing.

- Having these types of savings to fall back on could boost your financial resilience.

With Skipton Building Society’s range of Easy Access savings, you can regularly add more money to your account as there are generally no restrictions or penalties.

Your money is there when you need it. And in the meantime, it’s earning you valuable interest.

The interest rate paid on our Easy Access accounts is variable. This means it can go up and down over time. There are a few reasons why this might happen, such as Bank of England interest rate movements.

When you open an Easy Access account with Skipton Building Society, our Savings Account Terms and Conditions [PDF] explain why we might change your interest rate (section 8).

In general, there are no restrictions on how much you can pay in and withdraw – and how often you do it. However, some of our accounts only allow you to make a limited number of withdrawals each year. In return, they usually pay a higher rate of interest.

Each product has a minimum operating balance. You'll need to keep at least this amount in the account for it to remain open. If you want to withdraw more money that takes you below that, it would mean closing the account.

It’s very important to read all the information we provide about our accounts, before deciding whether to open it. We always set out if there are any restrictions on the amount you can save in the account and whether there are any restrictions on withdrawing money, to help you make an informed decision.

Since 1853, Skipton Building Society has been helping generations of people save for the future. We’re here to help you get your money working harder towards your goals and support your financial wellbeing. For example, you can get free advice on your savings through our My Money Review.

By opening a savings account with us, you will become a member of Skipton Building Society. This gives you access to our member offers, which may include exclusive savings rates and free services. You also get a say in how we’re run, with eligible members having the opportunity to vote at our Annual General Meeting (AGM).

Our purpose is to support our members. We don’t have shareholders, which means we don’t pay out dividends. Instead, we reinvest our profits to benefit our members and build a stronger Society for the future.

Your eligible deposits with Skipton Building Society are protected up to a total of £120,000 by the Financial Services Compensation Scheme (FSCS), the UK's deposit guarantee scheme.

Yes, you can open an account in any of our branches. To avoid disappointment, we recommend you call 0345 850 1722 to set up an appointment at a time and date to suit you.

Other ways to save

If you’re able to lock away your savings for a set period of time, we offer other types of savings accounts which may be more suitable. These could pay a higher amount of interest.

You're protected up to £120,000

Your eligible deposits with Skipton Building Society are protected up to a total of £120,000 by the Financial Services Compensation Scheme (FSCS), the UK's deposit guarantee scheme.

Jargon explained

AER

AER stands for Annual Equivalent Rate and show what the interest would be if interest was paid and added each year. All ISA interest is paid tax free, which means it's exempt from income tax. We pay all non ISA savings interest gross, which means no tax is deducted. It's your responsibility to pay any tax as due, based on your individual circumstances. Please be aware that products can be withdrawn at any time and without notice. Tax rules may change in the future.

Our new mobile app is coming

We’re gradually inviting members through our current app, so don't worry if your invite hasn't arrived yet. The new app is designed to make managing your accounts easier with a fresh look and features shaped by your feedback – plus more updates coming soon.

Find out more