EASaver

This account might be right for you if you:

- are happy with a variable rate of interest that can go up or down.

- would like access to your money.

- want to keep making payments into the account.

- are aged 16 or over.

Summary Box

It is important that you read all parts of the Summary Box before you apply.

Account Name

Easy Access Saver

What is the interest rate?

Balance:

£1+

Annual interest:

2.05% gross pa/AER

Monthly interest:

2.03% gross / 2.05% AER

- This account earns interest daily and it can be added to the account either annually or monthly.

- If you choose annual interest, it’s added to the account the day before the anniversary of account opening.

- If you choose monthly interest, it’s added to the account the day before the same date in the month the account was opened. For example, if the account was opened on the 30th of the month, monthly interest would be added on the 29th. If there’s no such date, it will be added on the last day of the month.

- If you ask us to pay interest to a different account, we’ll pay it on the first business day after we’d have added it to this account. Business days exclude Saturday, Sunday and bank holidays. Interest due in the first three days of the new tax year may arrive up to three business days later.

Can Skipton Building Society change the interest rate?

- Yes, the interest rate is variable, so it can go up or down.

- Section 8 of our Savings Account Terms and Conditions [PDF] explains why we may change the interest rate.

- If there is at least £100 in the account, we'll notify you in advance if we intend to reduce the interest rate.

What would the estimated balance be after 12 months based on a £1,000 deposit?

Opening balance:

£1,000

Estimated balance after 12 months:

£1,020

The estimated balance above assumes that:

- the account is opened with £1,000 and starts earning interest straight away.

- no further deposits or withdrawals are made.

- the interest is paid annually.

- the interest is added to this account.

- there is no change to the interest rates stated.

Estimated balances are for illustrative purposes only. They may be less for accounts opened by debit card or cheque, because interest won’t be earned until the account receives the deposit.

How do I open and manage my account?

- This account is only available to UK residents aged 16 or over.

- To open and manage this account, a valid email address must be provided.

- You can open and manage it through Skipton Online, in the Skipton App, in branch, by post or by phone. You may be required to set up appropriate security and access measures, and these might differ depending on how you choose to manage the account.

- The minimum opening and operating balance for this account is £1. You must keep at least this amount in the account at all times to keep it open.

- The minimum operating balance must be met for interest to be earned.

- Subsequent payments in can be made from £1.

- The maximum balance for this account is £1 million.

- Joint accounts are allowed, but cannot be opened in the Skipton App.

Can I withdraw money?

- Yes, as long as you’ve set up the relevant security and access measures, you can withdraw through Skipton Online, the Skipton App, in branch, by post or by phone, subject to the minimum operating balance.

- You don’t need to give us notice before you withdraw and there are no penalties.

- The minimum withdrawal amount is £1. You don't need to give us notice and there are no penalties.

- If you withdraw by electronic payment, this must be to a UK bank or building society account in your own name(s). We won’t make an electronic payment to any other type of account.

Additional information

- The Annual Equivalent Rate (AER) shows what the interest rate would be if interest was paid and added each year.

- We pay all savings interest gross, which means no tax is deducted. It’s your responsibility to pay any tax due, based on your individual circumstances. Tax rules may change in future.

- Accounts can be withdrawn from sale at any time and without notice.

EASaver

Before you apply

- You need an active email address to open this account. If you don't have one, call us or visit your local branch to discuss your options.

- You may need to prove your identity – to find out more about this, please read How to prove your name and address [PDF]

- Read these documents in full:

Easy Access Saver Account Terms and Conditions [PDF]

Savings Account Terms and Conditions [PDF]

You're protected up to £120,000

Your eligible deposits with Skipton Building Society are protected up to a total of £120,000 by the Financial Services Compensation Scheme (FSCS), the UK's deposit guarantee scheme.

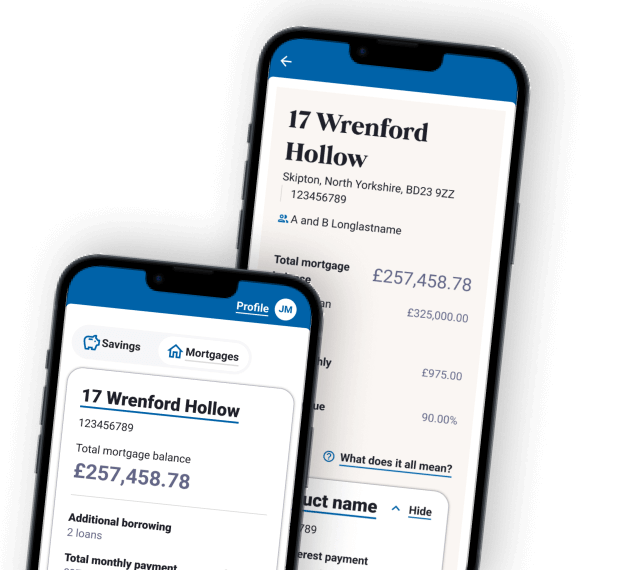

Our new mobile app is coming

We’re gradually inviting members through our current app, so don't worry if your invite hasn't arrived yet. The new app is designed to make managing your accounts easier with a fresh look and features shaped by your feedback – plus more updates coming soon.

Find out more