How does the Lifetime ISA government bonus work and when will it be paid?

The government will pay a 25% bonus on top of your contributions up to a maximum of £1,000 each tax year.

For example, each year you pay in up to £4,000. The government pays up to £1,000, totalling £5,000.

Your payments in...

Your bonus is calculated on any payments you make into your account from the 6th of the month to the 5th of the following month inclusive.

...your government bonus

Your bonus will be paid into your account within 14 days of the 20th day of month two.

Need to know more about Lifetime ISAs?

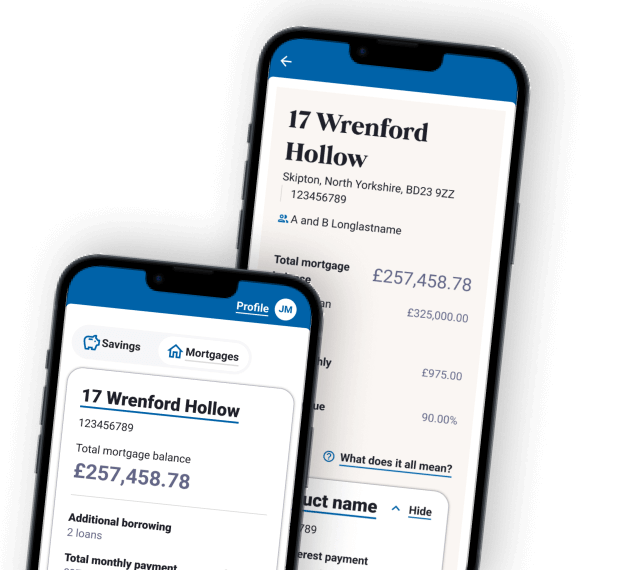

Our new mobile app is coming

We’re gradually inviting members through our current app, so don't worry if your invite hasn't arrived yet. The new app is designed to make managing your accounts easier with a fresh look and features shaped by your feedback – plus more updates coming soon.

Find out more