HMRC will calculate bonus payments for your Lifetime ISA on a month-by-month basis. Your bonus is calculated on any payments you make into your account from the 6th of the month to the 5th of the following month. Your bonus will be paid into your account within 14 days of the 20th of month two.

For example:

- Pay into your Lifetime ISA between 6 April and 5 May

- The bonus is then calculated between 6 May and 20 May

- Your bonus is paid by 3 June

The day we receive payment from HMRC, we pay it directly into your account, so you don’t lose any interest.

Important information

In order to receive the 25% government bonus you must ensure your details held at both Skipton and HMRC are correct and match. This includes both your first name and surname, date of birth and National Insurance number (you must not hold a temporary National Insurance number to qualify for a Lifetime ISA).

The 25% government withdrawal charge is only applied to the amount you withdraw. Where the 25% withdrawal charge applies the 25% government bonus is returned. And you'll also lose some of your own savings. This means you will receive back less than you paid in the account. The following example shows how it works (please note, this example doesn't include any interest earned).

| Actions | 25% government withdrawal charge |

|---|---|

| You open the account with | £4,000 |

| Government bonus is added | £1,000 |

| Total for first year | £5,000 |

| You make a chargeable withdrawal | £5,000 |

| The government withdrawal charge | -£1,250 |

| You receive back | £3,750 |

| You lose this much money | -£250 |

Yes, but you can only pay into one Lifetime ISA in each tax year. The maximum amount you can pay in each tax year is £4,000, up to and including the day before your 50th birthday.

You can withdraw from multiple Lifetime ISAs at the same time to buy your first home. However, you will need to wait 12 months from the date of your first payment into each account before being able to instruct your conveyancer. If you don't wait 12 months, the 25% government withdrawal charge will apply to any withdrawals from that Lifetime ISA.

During the same tax year, you can have one Lifetime ISA, plus a combination of Cash ISAs, Stocks & Shares ISAs and Innovative Finance (peer-to-peer) ISAs. The combined total of your ISA savings must not exceed the annual ISA allowance (£20,000 for the current tax year).

For example, if you save the maximum into a Lifetime ISA (£4,000 for the current tax year), you’d still have £16,000 remaining ISA allowance.

If you make a payment that exceeds your annual Lifetime ISA allowance (£4,000 for this tax year), we'll return the whole payment. You can make another payment, as long as it doesn't take you over your annual allowance.

You can transfer your Lifetime ISA into another Lifetime ISA without triggering the government withdrawal charge. However, if you transfer into a different type of ISA (Cash ISA, Stocks & Shares ISA or an Innovative Finance ISA) the transfer will be subject to the 25% government withdrawal charge. This means you’ll get back less than you paid in.

You can use your Lifetime ISA to buy your first home 12 months after your first payment into the account, without paying the 25% government withdrawal charge. If you’ve transferred from another provider, the 12 months starts from the date you paid into the original Lifetime ISA.

If you’re using your Lifetime ISA to save for retirement, you can withdraw for any reason, without having to pay the 25% government withdrawal charge, once you turn 60.

It's important to consider whether you might want to leave your Cash Lifetime ISA open. That way, you can continue to enjoy the government bonus and tax benefits. Once you reach 40, you're no longer eligible to open a new Lifetime ISA. However, you can continue to contribute to an existing one until you’re 50. If you wish to leave your Lifetime ISA open, you will need to leave at least £1 in your account.

Yes. After you open your account you have 30 days to notify us (in writing, in branch, online via web chat or by phone) if you want to cancel it.

- We’ll refund your money or transfer your funds to another account with Skipton or another provider without penalty or charge. This includes any interest earned from the date of account opening.

- If you open the account with money previously held in an ISA, and you later decide to cancel your account, your funds will not lose their ISA status. That is as long as your transfer them to another ISA.

- If you open the account with money not previously held in an ISA, and you later decide to cancel your account, your cancelled Lifetime ISA won’t count as a Lifetime ISA subscription. You’ll be able to subscribe into another Lifetime ISA during the same tax year if you’re still eligible. Any interest you’ve earned during this period will be paid gross. This means no tax is deducted. It’s your responsibility to pay any tax due, based on your individual circumstances.

There are different rules that apply depending on when your account was opened and the reason for your withdrawal.

Please see our Lifetime ISA withdrawal charges page.

You can pay into both. However, you can only use the bonus from either a Lifetime ISA or a Help to Buy ISA – and not from both – to buy your first home. You can use your Lifetime ISA to buy your first home 12 months after your first payment in. If you withdraw before that, you will trigger a 25% government withdrawal charge and you'd get back less than you paid in.

No, you can only receive the government bonus on either a Help to Buy ISA or a Lifetime ISA. You cannot claim the bonus for both accounts. You can transfer your Help to Buy ISA into a Lifetime ISA. These funds will count towards your Lifetime ISA allowance and your savings will be eligible for the government bonus.

Remember, if you transfer funds from other types of ISA into your Lifetime ISA, the start date of your account is the day you first paid into your Lifetime ISA. It is not the date you opened your previous ISA.

Other important information

A Cash Lifetime ISA may not be the best option for retirement savings. You might wish to consider investing in a pension, a Stocks and Shares Lifetime ISA, or both. Saving for retirement is usually a long-term commitment. Investing could give you a better return than a savings account over the long-term (more than five years). But you should be aware that the value of your investment can go down as well as up and you may get back less than you invested.

If you’re employed, you should consider your tax position and whether a workplace pension scheme might be better for you. If you choose to save in a Lifetime ISA instead of a private workplace pension scheme:

- You may lose the benefit of any employer contributions to that scheme.

- It could affect any means-tested benefits you may be entitled to, now or in the future. (As these depend on the amount of income and capital you have, which includes savings.)

If you’re thinking of using a Cash Lifetime ISA to save towards retirement, you should consider:

- when you plan to retire

- what else you’re doing to save for retirement (for example, paying into a pension); and

- whether the money you save in a Cash Lifetime ISA will be enough to meet your needs when you retire.

Lifetime ISAs are available as a Cash or a Stocks & Shares option. Skipton offers a Cash Lifetime ISA only.

Any time your circumstances change you should review whether the type of Lifetime ISA you have is still right for you.

This information isn’t advice. You should seek financial advice if you’re thinking of changing your existing pension plans to invest in a Lifetime ISA. If you don’t understand the pension and tax rules when you make changes, you may not make the most of your retirement savings. This could mean you don’t have enough money to support you when you’re retired.

The following table is designed to help you understand what the value of a Lifetime ISA might be at age 60. This would depend on the age at which you start saving and assumes:

You make the maximum annual subscription at the beginning of each tax year.

You continue to do this until you are aged 50.

You receive the Lifetime ISA government bonus each year and

This is based on the current allowance and bonus levels and assumes they do not change.

It may not be relevant if you’re saving in a Lifetime ISA for house purchase.

The estimated figures in columns 4 and 5 are based on standardised rates of return. These may not reflect actual or expected returns for your chosen Lifetime ISA and may not include the effect of inflation. These are not based on the current rate of interest for the Skipton Cash Lifetime ISA.

Column 6 shows how inflation which we assume to be 2%) and charges could reduce the amount that would be returned from a Lifetime ISA. As the Skipton Cash Lifetime ISA has no management charges, these have not been included. It's worth bearing in mind that charges will normally apply for Stocks and Shares Lifetime ISAs.

You can use column 6 to compare a Lifetime ISA offering 5% returns (without management charges) to other Lifetime ISAs or long-term savings products. This may not match the current rate on the Skipton Cash Lifetime ISA. If our rate is less than the 5% used in the illustration, the estimated outcome at age 60 could be much less than the figure provided in column 5.

| 1. Age saving in a Lifetime ISA started | 2. Total amount paid in by Lifetime ISA saver/investor | 3. Total amount paid in, plus Lifetime ISA government bonus | 4. Estimated outcome at age 60 from 0% return | 5. Estimated outcome at age 60 from 5% return | 6. Charges and estimated inflation would reduce a 5% return to |

|---|---|---|---|---|---|

| 18 | £128,000 | £160,000 | £95,310 | £363,380 | 3% |

| 25 | £100,000 | £125,000 | £79,380 | £252,341 | 3% |

| 30 | £80,000 | £100,000 | £66,539 | £185,974 | 3% |

| 35 | £60,000 | £75,000 | £52,334 | £128,726 | 3% |

| 40 | £40,000 | £50,000 | £36,619 | £79,343 | 3% |

Buying a house with your Lifetime ISA

We’ve pulled together what you need to know about using your Lifetime ISA to buy your first home.

For each Lifetime ISA you open, you will need to wait 12 months from the date of your first payment into the account before being able to instruct your conveyancer when buying your first home. If you don't wait 12 months the 25% government withdrawal charge will apply.

You can only use the money from the Lifetime ISA for a deposit. You need to purchase the property with a mortgage (not a Buy to Let mortgage). The mortgage can’t be a loan from a connected party. A connected party is defined as:

- your spouse or civil partner

- your relative

- a relative of your spouse or civil partner

- the spouse or civil partner of a relative of yours

- the spouse or civil partner of a relative of your spouse or civil partner.

The property must be in the UK and be for you to live in as your main residence immediately on completion. The purchase price must be no more than £450,000. Withdrawals that don't satisfy these conditions will be subject to a government withdrawal charge of 25% of the amount withdrawn.

Please note:

If you or your spouse/partner are a UK Crown employee serving overseas, you must intend to reside in the UK and use the property as your main residence in the future.

Yes. If you are both first-time buyers, and each held a Lifetime ISA for at least 12 months, you can both use your Lifetime ISAs to buy a home. You won’t have to pay the 25% government withdrawal charge.

If the person you’re buying with has owned a property before, they wouldn’t be able to use their Lifetime ISA without triggering the government withdrawal charge. However, you, as a first-time buyer, would still be able to use your own Lifetime ISA towards the price of the home you are buying together.

If you’re using the Shared Ownership scheme to buy your first home, it can be used towards the deposit when you buy your initial share. However, it can’t be used again without paying the 25% government withdrawal charge to buy any further shares.

You’ll be unable to use it without paying the government withdrawal charge if you already own a property. If you’re unsure whether you already legally own the property, or need any clarification, you should seek some independent advice.

You can give our Conveyancer Declaration [PDF] to your conveyancer along with your completed Investor Declaration Form [PDF]. Alternatively, your conveyancer can find both of these forms on our Information for conveyancers page, as well as more information about our Lifetime ISA first time buyer withdrawal process.

Your conveyancer should send us these at least 30 days before your completion date.

- We require the completion date so we can process the request and prioritise the withdrawal for a first house purchase request.

- If we don’t have this, we’ll release the funds to your conveyancer within 30 days from when we receive the request.

You or your conveyancer should contact us as soon as possible if:

- your form was sent without a completion date, and

- your completion date is now set for less than 30 days after we receive your form.

If we have received a completion date on your declaration form, we aim to release the money within 48 hours before your completion date.

If we do not have this, we will release the funds to your conveyancer 30 days after we receive the request.

You or your conveyancer should contact us as soon as possible if:

- your form was sent without a completion date, and

- your completion date is now set for less than 30 days after we receive your form

90 days from your conveyancer receiving the funds from us. If it’s taking longer than this, the conveyancer can write to us to request an extension.

The conveyancer can request withdrawals from the account on your behalf as many times as you wish up to completion. There is no minimum withdrawal amount. We need completed declarations from both you and your conveyancer each time a withdrawal is requested.

The conveyancer must return the funds within 10 business days of the house purchase falling through. The amount withdrawn will be paid back into your account.

If the first house purchase withdrawal closed the account, it’ll be reopened when the funds are returned. However, your membership won’t be backdated (if this was the only Skipton account you held).

If the conveyancer returns less than the amount withdrawn, or doesn’t return the funds, you’ll be charged a 25% government withdrawal charge on the shortfall amount.

When closing your account, if we are aware that a bonus is due you should leave £1 in your account to allow the bonus to come in.

If we are unaware that a bonus is due and your account is closed, it’ll be reinstated and the bonus paid in. We’d record a break in membership with the Society on the system if you don’t have any other accounts with us.

We’d then contact you to confirm we’ve received the bonus and ask you what you’d like to do with the amount received. You would have to pay the 25% government withdrawal charge if you choose to withdraw it before the age of 60.

For example, if a bonus of £500 is due, the withdrawal charge would be £125 to close the account. So you would only receive £375 of the bonus amount. You could, however, leave the account open, save for retirement and access when you are 60, without incurring the charge.

- Subject to our normal affordability assessment and lending criteria at the time, Lifetime ISA customers, who are buying their first home with a Skipton mortgage, will be eligible for £250 cashback once the house purchase has completed.

- This offer is only valid for mortgages completing from 6 April 2018 to 30 June 2027.

- Cashback will be paid for new mortgages where at least one of the applicants is a Skipton Lifetime ISA customer buying their first home.

- If the mortgage is in joint names and with another Skipton Lifetime ISA holder, only one cashback amount will be paid.

- Cashback will only be available once.

You could lose your home if you don’t keep up your mortgage repayments.

Your loan can be up to 5.5x your income up to 95% loan to value, including new build houses and flats.

Learn more about lifetime ISA

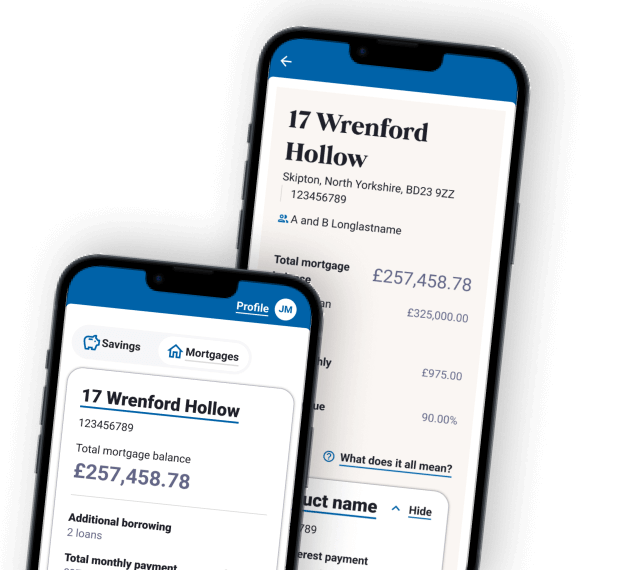

Our new mobile app is coming

We’re gradually inviting members through our current app, so don't worry if your invite hasn't arrived yet. The new app is designed to make managing your accounts easier with a fresh look and features shaped by your feedback – plus more updates coming soon.

Find out more