ISASaver

This account might be right for you if you:

- would like easy, flexible access to your money without affecting your ISA allowance.

- want to be able to transfer in ISA savings from other ISAs.

- are aged 18 or over.

Summary Box

It is important that you read all parts of the Summary Box before you apply.

Account Name

Cash ISA Saver

What is the interest rate?

Balance:

£1+

Annual interest:

2.05% tax-free pa/AER

Monthly interest:

2.03% tax-free / 2.05% AER

- This account earns interest daily and it can be added to the account either annually or monthly.

- If you choose annual interest, it’s added to the account the day before the anniversary of account opening.

- If you choose monthly interest, it’s added to the account the day before the same date in the month the account was opened. For example, if the account was opened on the 30th of the month, monthly interest would be added on the 29th. If there’s no such date, it will be added on the last day of the month.

- If you ask us to pay interest to a different account, we’ll pay it on the first business day after the day we’d have added it to this account. Business days exclude Saturday, Sunday and bank holidays. Interest due in the first three days of the new tax year may arrive up to three business days later.

Can Skipton Building Society change the interest rate?

- Yes, the interest rate is variable, so it can go up or down.

- Section 8 of our Savings Account Terms and Conditions [PDF] explains why we may change the interest rate.

- If there is at least £100 in the account, we'll notify you in advance if we intend to reduce the interest rate.

What would the estimated balance be after 12 months based on a £1,000 deposit?

Opening balance:

£1,000

Estimated balance after 12 months:

£1,020

The estimated balance above assumes that:

- the account is opened with £1,000 and starts earning interest straight away.

- no further deposits or withdrawals are made.

- the interest is paid annually.

- the interest is added to this account.

- there is no change to the interest rates stated.

Estimated balances are for illustrative purposes only. They may be less for accounts opened by debit card or cheque, because interest won’t be earned until the account receives the deposit.

How do I open and manage my account?

- This account is only available to UK residents aged 18 or over. However, if you’re not a UK resident, you may still be able to open this account if you meet the government’s ISA requirements. Please see the ISA Declaration [PDF] on our application form for more details.

- To open and manage this account, a valid email address must be provided.

- You can open and manage it through Skipton Online, in the Skipton App, in branch, by post or by phone. You may be required to set up appropriate security and access measures, and these might differ depending on how you choose to manage the account.

- The minimum opening and operating balance for this account is £1. You must keep at least this amount in the account to keep it open.

- The minimum operating balance must be met for interest to be earned.

- Subsequent payments in can be made from £1.

- You can pay in your total ISA allowance each tax year (currently set at £20,000 per tax year).

- You can also request transfers in from other ISAs you have with us or other providers. You can find information on how to transfer an existing ISA into this account in the Cash ISA Saver Key Features and Account Terms and Conditions [PDF].

- The maximum balance for this account is £1 million.

- Joint accounts aren’t allowed.

Can I withdraw my money?

- Yes, as long as you’ve set up the relevant security and access measures, you can withdraw through Skipton Online, the Skipton App, in branch, by post or by phone, subject to the minimum operating balance.

- The minimum withdrawal amount is £1. You don’t need to give us notice and there are no penalties.

- This account is flexible, so you can withdraw money and put it back without affecting your ISA allowance, as long as it’s done in the same tax year and the account is still open.

- If you withdraw by electronic payment, this must be to a UK bank or building society account in your own name. We won’t make an electronic payment to any other type of account.

Additional information

- The Annual Equivalent Rate (AER) shows what the interest rate would be if interest was paid and added each year.

- All ISA interest is paid tax-free, which means it’s exempt from income tax. Tax rules may change in future.

- Accounts can be withdrawn from sale at any time and without notice.

ISASaver

Before you apply:

- You will need an active email address. If you don't have one, call us or visit your local branch to discuss your options.

- You will need to provide your National Insurance number, so it's a good idea to have it to hand before you begin.

- You may need to prove your identity - to find out more about this, please read How to prove your name and address [PDF]

- Read these documents in full:

Cash ISA Saver Key Features and Account Terms and Conditions [PDF]

Savings Account Terms and Conditions [PDF]

You're protected up to £120,000

Your eligible deposits with Skipton Building Society are protected up to a total of £120,000 by the Financial Services Compensation Scheme (FSCS), the UK's deposit guarantee scheme.

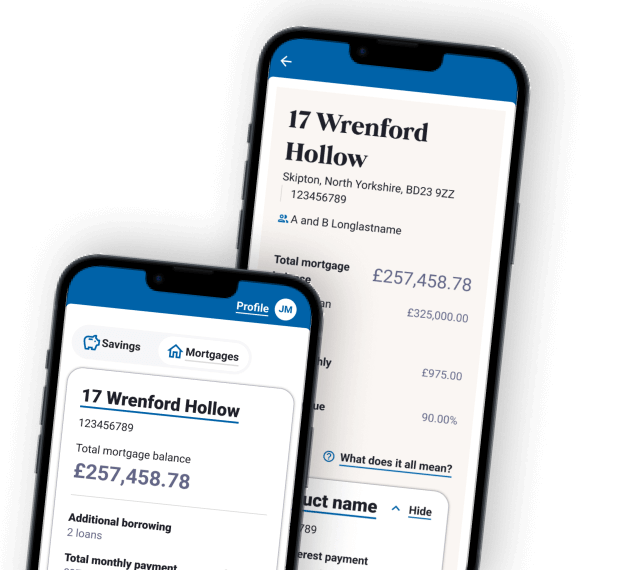

Our new mobile app is coming

We’re gradually inviting members through our current app, so don't worry if your invite hasn't arrived yet. The new app is designed to make managing your accounts easier with a fresh look and features shaped by your feedback – plus more updates coming soon.

Find out more